JL MAG Rare-earth Industry Price Briefing 2510(Issue No.546)03-17~03-21

Week 12,2024

1. 重要新闻简报Briefing of Important News

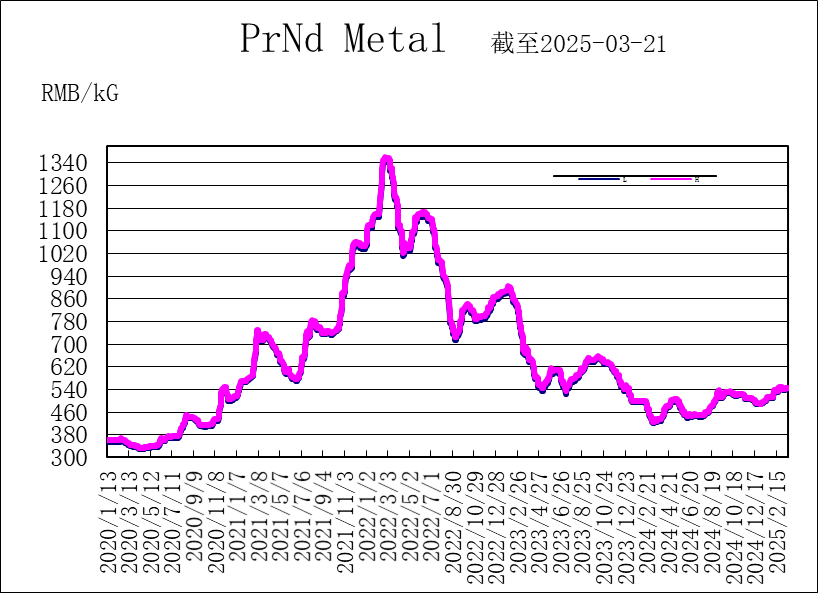

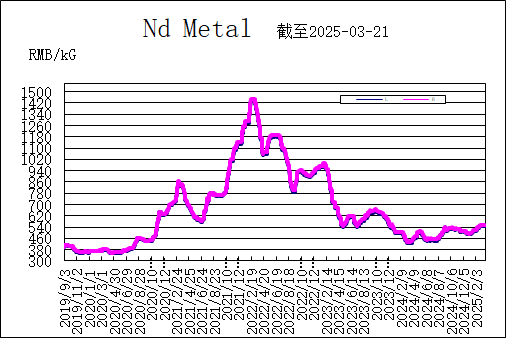

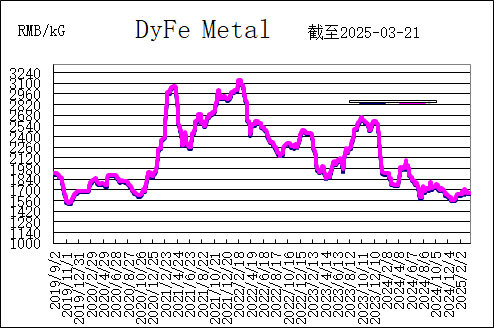

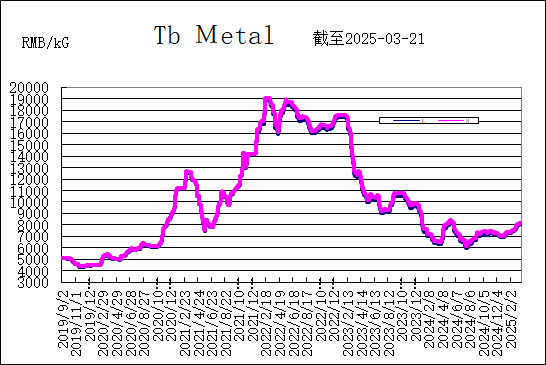

本周稀土市场行情,镨钕价格出现较小幅度上涨,金属铽、金属钕、镝铁合金价格保持不变。亚洲金属网周末价格: 镨钕金属价格543-546元/KG;金属钕价格550-555元/KG;镝铁合金价格1640-1660元/KG;金属铽价格8050-8150元/KG。

This week in the rare earth market, PrNd prices saw a slight increase, while the prices of Tb, Nd, and DyFe alloy remained stable. Asian Metal's weekend prices are as follows: PrNd metal 543-546 RMB/KG; Nd metal 550-555 RMB/KG; DyFe alloy 1640-1660 RMB/KG; Tb metal 8050-8150 RMB/KG.

2. 业内人士分析Analysis of Professional Insiders

本周(3月17-21日)本周稀土价格维持弱稳走势,市场活跃度不高,观望情绪占据主导。原料趋紧仍是目前稀土市场运行的长期逻辑。2025年前两个月进口稀土16922.2吨,环比减少19.3%,尤其是美国、缅甸两国稀土进口量明显减少,稀土供应不足的情况仍将持续。随着成本压力向上游传导,稀土产业面临“高需求、低成本”的新挑战。

This week (Mar. 17th to Mar. 21th), rare earth prices remained weakly stable with low market activity, as a wait-and-see sentiment dominated. Tight supply of raw materials continues to be the long-term driving factor in the rare earth market. In the first two months of 2025, China imported 16,922.2 tons of rare earths, a 19.3% decrease compared to the previous period. Notably, imports from the U.S. and Myanmar declined significantly, indicating that the supply shortage may persist. As cost pressures move upstream, the rare earth industry faces a new challenge: high demand amid constrained low-cost supply.

上周下游大厂集中招标采购完成后,镨钕主流产品采购量快速减少,氧化镨钕价格略有回落,商家观望增多,尽管询盘依旧积极,但大多为试探性询价,多数逢低成交,市场活跃度降低。金属厂报价相对坚挺,对氧化镨钕下跌起到稳定作用。金属铈延续了上周的高报价,市场现货的紧张,带动了氧化铈的交易,市场询价积极。镝铽产品受到市场关于缅甸开关消息的影响,部分持货企业出货意愿增强,价格略微下跌。短期来看,稀土价格走弱可能仍将持续一段时间,但大部分企业仍看好后市发展,随着零散小单成交进行,未来稀土价格仍有望增长。(包头稀土产品交易所)

Following the completion of centralized tendering and procurement by major downstream manufacturers last week, purchasing volumes for mainstream PrNd products declined rapidly, resulting in a slight correction in PrNd oxide prices. Market sentiment turned more cautious, with increased wait-and-see attitudes among traders. While inquiries remained active, most were merely price testing, and transactions predominantly occurred at discounted levels, leading to reduced market activity. Metal producers maintained relatively firm offers, which helped cushion the downward pressure on PrNd oxide prices. Ce metal sustained its premium pricing from the previous week, and tight spot availability stimulated active trading in Ce oxide, attracting robust market inquiries. For Dy and Tb products, prices edged lower as news about the potential reopening of Myanmar's border prompted some holders to increase sales. In the short term, the current softness in rare earth prices may persist in the near term. However, most market participants remain optimistic about medium-to-long-term prospects, anticipating a potential price recovery as scattered small orders continue to be executed. (Source: Baotou Rare Earth Products Exchange)

3.趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

2025年03月24日

March 24th, 2025

提示:以上信息仅供参考!

Notes: the information above is for reference only!

- Previous Article : JL MAG Rare-earth Industry Price Briefing 2509(Issue No. 545)03-10~03-...

- Next Article : No Information

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :