JL MAG Rare-earth Industry Price Briefing 2509(Issue No.545)03-10~03-14

Week 11,2024

1. 重要新闻简报Briefing of Important News

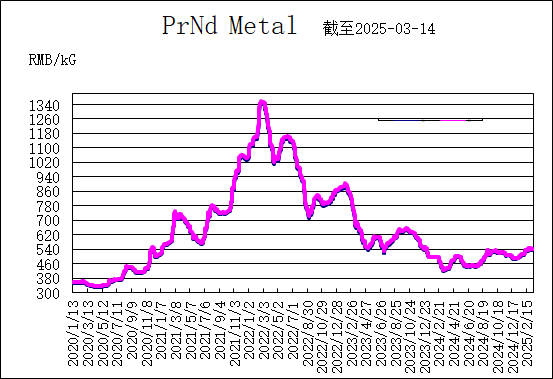

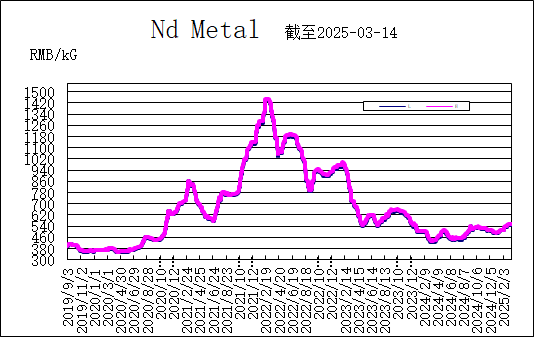

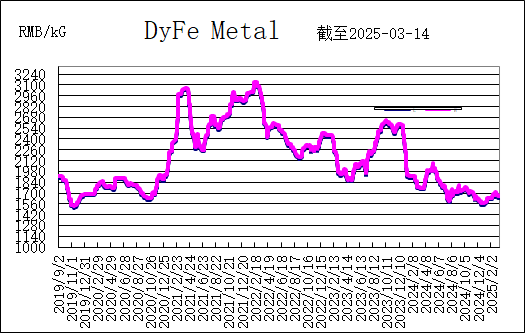

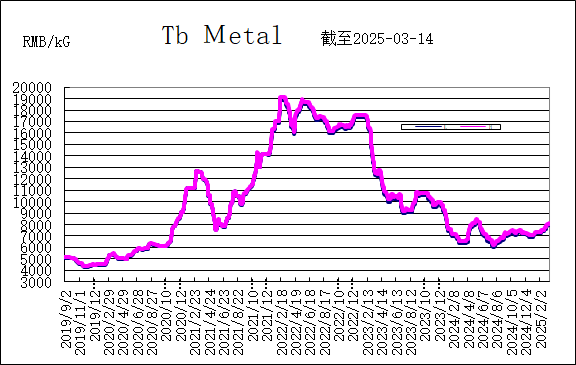

本周稀土市场行情,镨钕、金属铽和金属钕价格出现较大幅度上涨,镝铁合金价格保持不变。亚洲金属网周末价格: 镨钕金属价格541-544元/KG;金属钕价格550-555元/KG;镝铁合金价格1640-1660元/KG;金属铽价格8050-8150元/KG。

This week, the rare earth market has seen significant price increases for PrNd, Tb metal, and Nd metal, while DyFe alloy remains unchanged. According to Asian Metal's weekend data, the prices are as follows: PrNd metal 541-544 RMB/KG; Nd metal 550-555 RMB/KG; DyFe alloy 1640-1660 RMB/KG; Tb metal 8050-8150 RMB/KG.

2. 业内人士分析Analysis of Professional Insiders

本周(3月10-14日)稀土市场总体平稳,市场活跃度尚佳,商家出货意愿较强,低价货源较少,稀土价格较上周略有增长。

This week (Mar. 10th to Mar. 14th), the rare earth market remained stable, with moderate market activity. Sellers showed a strong willingness to clear their inventories, while low-priced supplies were limited. Overall, rare earth prices saw a slight increase compared to the previous week.

截至周四,氧化镝报价170.20万元/吨,氧化铽报价660.25万元/吨,2025年已分别增长5.7%和18.3%,氧化钆、氧化钬等其他产品涨幅较大。同时,我国对稀土开采管理愈加严格,业内调低国内稀土产量预期,内外因素作用下,2025年稀土原料供给或长期趋紧。当前全球经贸陷入低增长,外部环境的不稳定严重影响我国经济外循环,稀土终端产业压力剧增。随着成本压力向上传导,大型磁材厂家介入低端产品市场,中小磁材厂家经营愈发谨慎,导致在稀土磁材订单充足的情况下,稀土采购量未见明显增长。(包头稀土产品交易所)

As of Thursday, the prices of Dy oxide and Tb oxide were 1.702 million RMB/ton and 6.6025 million RMB/ton, respectively. By 2025, these prices have increased by 5.7% and 18.3%, respectively. Other products such as Gd oxide and Ho oxide have also experienced significant price increases. Meanwhile, China has been strengthening regulations on rare earth mining, prompting industry experts to revise down their forecasts for domestic rare earth production. Under the combined influence of internal and external factors, the supply of rare earth raw materials may experience long-term supply constraints by 2025. Currently, global trade and economic growth have stagnated, and the instability of the external environment has severely affected China's external economic cycle. This has significantly increased pressure on downstream industries dependent on rare earth materials. As cost pressures are passed upstream, large magnetic material manufacturers have started entering the low-end market, while small and medium-sized manufacturers have become more cautious in their business operations. Despite strong demand for rare earth magnetic materials, there has been no significant increase in the procurement of rare earth raw materials. (Source: Baotou Rare Earth Products Exchange)

3. 趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

![]()

2025年03月17日

March 17th, 2025

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :