JL MAG Rare-earth Industry Price Briefing 2507(Issue No.543)02-24~02-28

Week 09,2024

1. 重要新闻简报Briefing of Important News

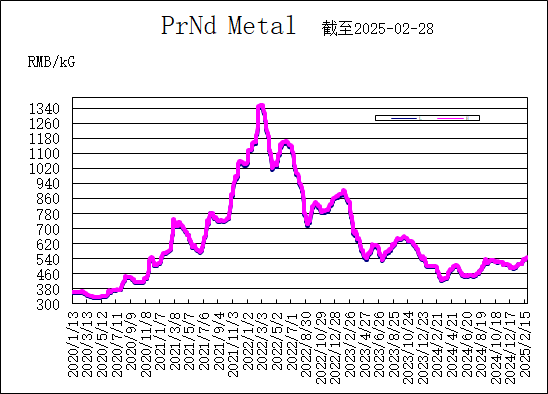

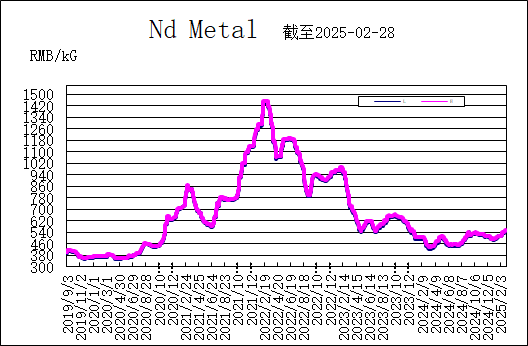

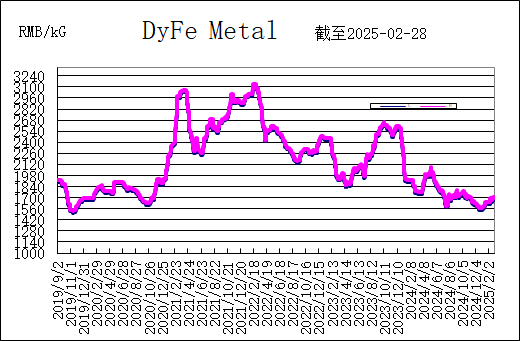

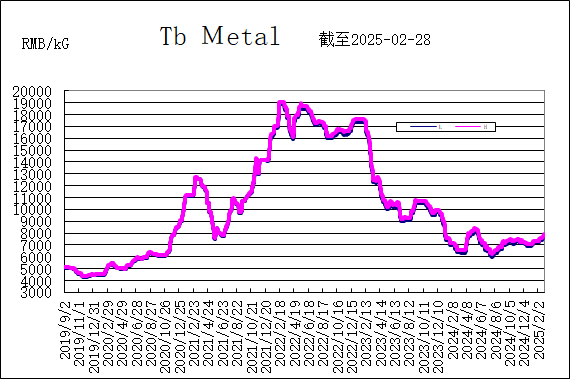

本周稀土市场行情,镨钕、金属钕和金属铽价格上涨,镝铁合金价格小幅下跌。亚洲金属网周末价格: 镨钕金属价格544-547元/KG;金属钕价格548-553元/KG;镝铁合金价格1670-1690元/KG;金属铽价格7850-7950元/KG。

This week's rare earth market trend saw an increase in the prices of PrNd metal, Nd metal, and Tb metal, while the price of DyFe alloy slightly decreased. Asian metal weekend prices: PrNd metal 544-547 RMB/KG; Nd metal 548-553 RMB/KG; DyFe alloy 1670-1690 RMB/KG; Tb metal 7850-7950 RMB/KG.

2. 业内人士分析Analysis of Professional Insiders

本周(2月24-28日)稀土市场价格持续上扬,2月24日工信部发布《稀土开采和冶炼分离总量调控管理办法(暂行)》,首次将进口矿及独居石纳入指标管理,进一步收紧供给端。政策要求仅大型稀土集团具备合规生产资质,并建立全链条追溯系统,推动行业集中度提升。此举缓解国内供给过剩压力,支撑价格底部回升,尤其利好磁材头部企业。缅甸作为中国中重稀土主要进口来源国,2025年进口量或下滑30%~42%,加剧全球中重稀土供应紧张,稀土价格弹性有望增强。

This week (February 24-28), rare earth market prices continued to rise. On February 24th, the Ministry of Industry and Information Technology issued the "Interim Measures for the Control and Management of Total Amount of Rare Earth Mining and Smelting Separation", which for the first time included imported minerals and monazite in the index management, further tightening the supply side. The policy requires only large rare earth groups to have compliant production qualifications and establish a full chain traceability system to promote industry concentration. This move alleviates the pressure of domestic oversupply and supports a bottoming out of prices, especially benefiting leading magnetic material companies. As the main source of China's imports of medium and heavy rare earths, Myanmar's import volume is expected to decline by 30% to 42% in 2025, exacerbating the global shortage of medium and heavy rare earths and increasing the price elasticity of rare earths.

2月稀土市场在政策与需求的“跷跷板效应”中完成筑底反弹,3月将进入“政策红利兑现+终端需求放量”的关键窗口期。预计产业链价格传导逐步顺畅,行业景气度由上游向中下游扩散,稀土板块或迎来“量价齐升”的阶段性行情。(包头稀土产品交易所)

In February, the rare earth market completed a bottoming out rebound in the "seesaw effect" of policies and market demands, and in March, it will enter a critical window period of "policy dividends realization + increased terminal demand". It is expected that the transmission of prices in the industrial chain will gradually become smooth, and the industry prosperity will spread from upstream to midstream and downstream. The rare earth sector may usher in a phase of "simultaneous increase in quantity and price". (Baotou Rare Earth Products Exchange)

3. 趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

![]()

2025年03月03日

March 03rd, 2025

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :