JL MAG Rare-earth Industry Price Briefing 2506(Issue No.542)02-14~02-21

Week 08,2024

1. 重要新闻简报Briefing of Important News

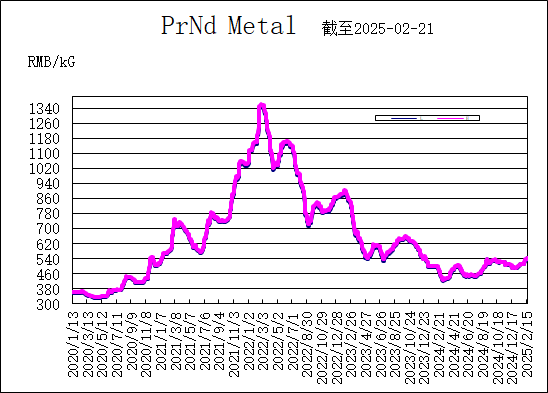

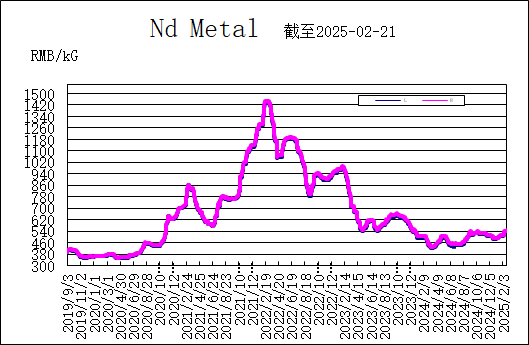

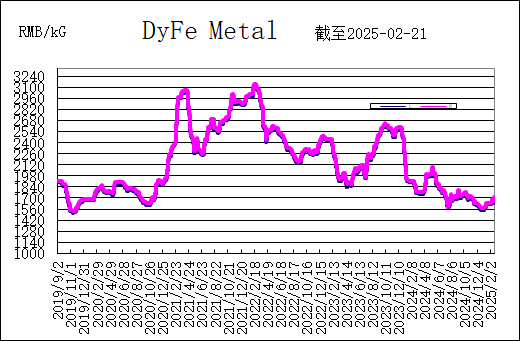

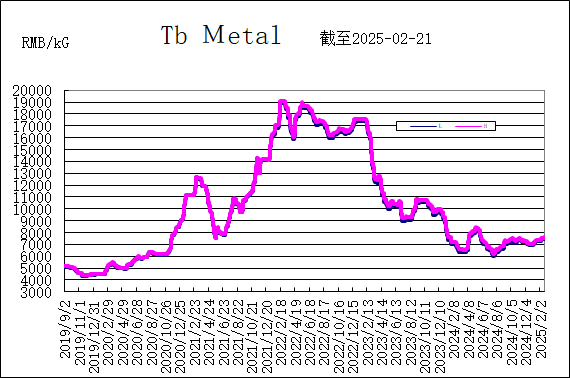

本周稀土市场行情,镨钕、金属钕、金属铽和镝铁合金价格均出现较大幅度上涨。亚洲金属网周末价格: 镨钕金属价格542-545元/KG;金属钕价格545-550元/KG;镝铁合金价格1690-1710元/KG;金属铽价格7550-7650元/KG。

This week, rare earth market has a drastically increase in prices for PrNd, Nd metal, Tb metal, and DyFe alloy. Asia Metal weekend prices: PrNd metal price is 542-545 RMB/KG, Nd metal is 545-550 RMB/KG, DyFe alloy is 1,690-1,710 RMB/KG, and Tb metal is 7,550-7,650 RMB/KG.

2. 业内人士分析Analysis of Professional Insiders

本周(2月17-21日)稀土市场经历了一场由预期看弱到信心回升的过程,2月19日是个转折点,在这之前,市场虽稳,但对短期预判看弱居多,主流稀土产品报价与成交价在震荡边缘徘徊,2月20日,高报价迭起,主流稀土价格突破此前高位,市场信心再次恢复。

This week (February 17-21), the rare earth market experienced a shift from weak expectations to renewed confidence, with February 19 marking a turning point. Prior to this date, the market remained stable but was dominated by short-term bearish sentiment, as mainstream rare earth product quotations and transaction prices hovered near volatile levels. By February 20, high quotations surged, with mainstream rare earth prices breaking through previous highs, reigniting market optimism.

本周前期的成交多以补单及刚需采购为主,氧化镨钕的坚挺彰显龙头企业稳价的态度,金属趋弱又暗显下游接单价格的不易,当周后期价格不断突破半年前高价后,上下游均有理性顾虑存在,本轮历时两个月的起涨至,走三步退一步的螺旋向上走势,充满了不确定性。此前据传的进口矿纳入配额的消息落地,重稀土价格向上期望仍存,尽管本周有部分贸易低价出货,但出货量毕竟有限,从目前来看,重稀土畏高抛货的可能性不大,毕竟市场流通现货依旧趋紧,短期内保稳或成为大概率可能,但中期来看或可保乐观。(瑞道稀土资讯)

In the early stage of the week, transactions primarily consisted of supplemental orders and rigid demand purchases. The resilience of PrNd oxide prices reflected major producers' commitment to stabilizing the market, while weaker metal prices hinted at downstream buyers' reluctance to accept higher costs. As prices surpassed six-month highs later in the week, both upstream and downstream players exhibited cautious concerns. The current two-month upward trend, characterized by a "three steps forward, one step back" spiral trajectory, remains fraught with uncertainty. Following the official confirmation of earlier rumors about import quotas for rare earth ores, expectations for heavy rare earth price increases persist. Despite some low-priced trades this week, the limited volume of such transactions suggests minimal likelihood of panic selling in heavy rare earths, given ongoing tightness in spot market supply. While short-term stability appears probable, medium-term prospects remain cautiously optimistic. (Ruidow Rare Earth Information)

3. 趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

![]()

2025年02月27日

February 27th, 2025

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :