金力永磁稀土行情简报201610期(总第126期)03-13~03-19

JL MAG Rare-earth Industry Price Briefing 03-13~03-19

2016年第12周

Week 12, 2016

1. 重要新闻简报Briefing of Important News

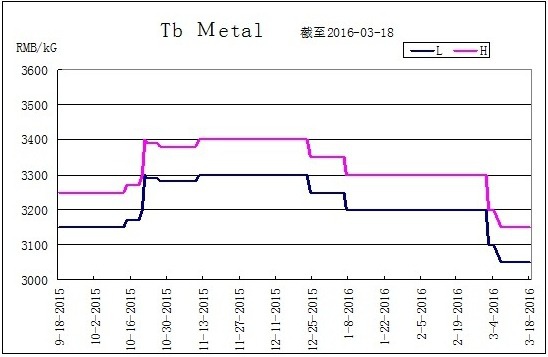

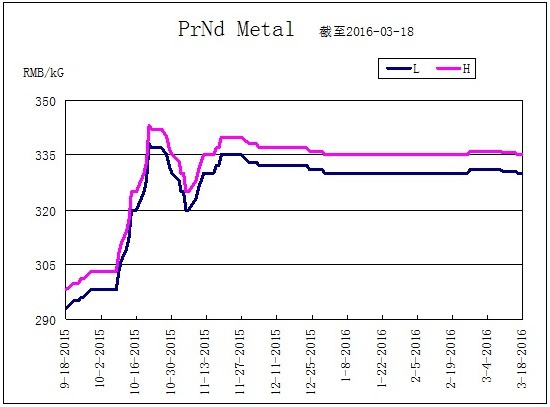

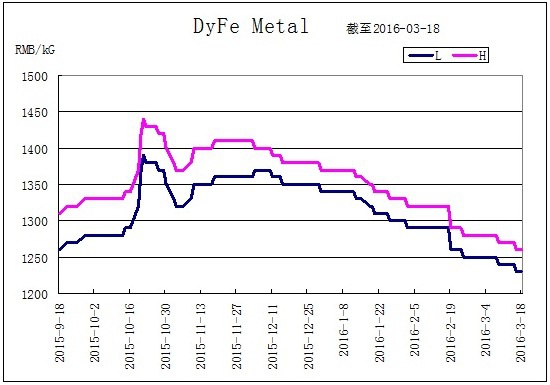

n 本周稀土市场镨钕镝铁价格均有所下滑,铽价格相对稳定。亚洲金属网价格:镨钕金属330-335元/KG,镝铁合金价格1230-1260元/KG,铽金属价格3050-3150元/KG。

This week the prices of PrNd and DyFe declined while the price of Tb was relatively stable. Prices from Asian Metal present: PrNd 330-335 RMB/KG, DyFe 1230-1260RMB/KG, Tb metal 3050-3150RMB/KG.

n 由于稀土价格低迷导致莱纳公司现金流持续疲软,该集团公布损失共计9.6亿美元。

Cash flow of Lynas was continuously weak because of the low rare earth price and they announced a total loss of $960 million.

n 据中国汽车工业协会消息,2016年1-2月,新能源汽车产销37937辆和35726辆,同比均增长1.7倍。

According to the news from China Automobile Industry Association, the production and marketing of the new energy vehicles had achieved 37937 and 35726 in January and February of 2016 with a year-on-year increase of 1.7times.

n 据海关统计数据显示,1月份,我国总计出口稀土永磁材料2152.4吨,环比下降10.6%(上月为2408.6吨),出口金额1.11亿美元,环比下降8%。我国稀土永磁体的主要出口国家和地区为:美国260.1吨,占12.1%;丹麦:247.9吨,占11.5%;德国227.1吨,占10.5%;韩国212.3吨,占9.9%。

According to the customs statistics that in January the total export of China permanent magnet materials were 2152.4 tons, with a month-on-month decrease of 10.6% (the last month was 2408.6 tons); and the export amount was 111 million dollars, with a month-on-month decrease of 8%. The main export countries and regions of rare earth permanent magnets are as follows: America 260.1 tons, accounting for 12.1%; Denmark 247.9tons, accounting for 11.5%; Germany 227.1 tons, accounting for 10.5%; Korea 212.3 tons, accounting for 9.9%.

2.业内人士分析Analysis of Professional Insiders

稀土行业深度报告:稀土行业有望在2016年走出寒冬

Depth report of rare earth industry: rare earth industry is expected to come out of the winter in 2016

我们认为,中国稀土战略资源地位不可动摇,稀土价格将在供给缩减、行业深度整合和政策打黑执行力度加大下开始中长期修复。十三五期间稀土新材料迎来新机遇,稀土下游需求将逐步回暖,随着去产能效果逐步显现,2016年稀土行业有望走出寒冬。

We believes that the strategic resource status of rare earth in China is unshakable, rare earth prices would start a medium and long term recovery under the circumstance of shrinking supply, industry integration and increasing implementation strength on cracking down illegal mines. During the 13th five-year plan, rare earth materials will meet a new opportunity, as the downstream market demands of rare earth will gradually rebound and with the DE-capacity effects gradually appeared, rare earth industry is expected to come out of the winter in 2016.

中国稀土对全球市场的主导地位仍然存在。USGS统计2015年中国稀土储量5,500万吨,占全球储量的42%;中国稀土产量10.5万吨,占全球比重的85%;中国稀土消费量13.8万吨,占全球稀土总消费量的65%.

Chinese rare earth is still in the dominant position in the global market. And Chinese rare earth reserves is the top one in the world. Statistics from the USGS that Chinese rare earth reserves in 2015 is 55 million tons, which accounting for 42% of the global reserves; Chinese rare earth output is 0.105 million tons, which accounting for 85% of the global inputs; and China's rare earth consumption is 0.138 million tons, which accounting for 65% of the global total consumption.

六大稀土集团整合即将完毕,联合保价限产,提振稀土价格。国家对稀土仍然采取严格管控制度,2016年稀土矿开采配额与前两年相比几乎不变,导致稀土产量高于配额的原因是盗采。六大稀土集团先后加入保价限产阵营,实施10%左右的减产,缩减稀土供给。

The integration of the sixth rare earth groups will soon be completed and they will united limited production price to boost the rare earth prices. In China, the rare earth was still strictly under control. The quota of rare earth mining in 2016 is almost unchanged compared to the previous two years, while the outputs of rare earth is much higher than the quota, which is mainly because of illegal mining. The sixth rare earth groups successively joined in the side of limited production price to boost the prices, reducing about 10% in production as well as the rare earth supply.

“十三五"稀土新材料迎来新机遇,加大私矿黑矿打击力度,缓解产能过剩。在稀土行业里,“黑色产业链"供应量占到总供应量的50%左右,2016年,打击黑稀土仍是国家政策监管,私矿的不断扫除将为稀土行业回暖打好基础。

During the 13th five-year plan, rare earth materials will meet a new opportunity with strengthen the fight against illegal mining and ease the overcapacity. The illegal mining supply accounted for about 50% of the total supply in the rare earth industry, therefore the fight against the illegal mining is still the key point of China policy regulation. Furthermore, the continuous fight against illegal mining will lay a solid foundation on the rare earth industry rebound.

风险因素:供给收缩未见成效;国内稀土大集团方案实际整合步伐低于预期;美联储继续加息;稀土需求大幅回落;全球经济继续下滑;金属价格大幅下跌;供给侧改革不及预期。

Risk factors: supply contraction without success; the actual integration of the sixth rare earth groups do not achieve the results as we expected before; the Federal Reserve interest rates continue to rise; the demand for rare earths significantly fell down; the global economy continued declining; metal prices fell sharply; result of supply-side reform is less than expected.

3.趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

2016年03月19日

March 19th, 2016

提示:以上信息仅供参考!

Notes: the information above is for reference only!

关注我们

关注我们

股票代码

股票代码  Language

Language

当前位置:

当前位置: 86-797-8068888

86-797-8068888 赣公网安备 36070002000228号

赣公网安备 36070002000228号