金力永磁稀土行情简报1650期(总第166期)12-26~12-30

JL MAG Rare-earth Industry Price Briefing 12-26~12-30

2016年第53周

Week 53, 2016

1.重要新闻简报Briefing of Important News

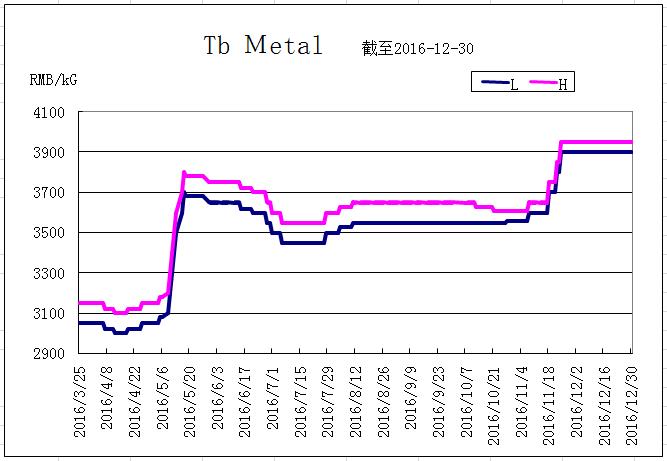

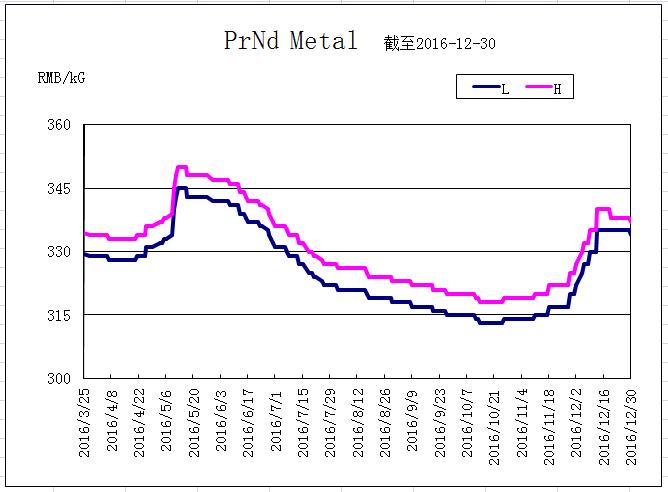

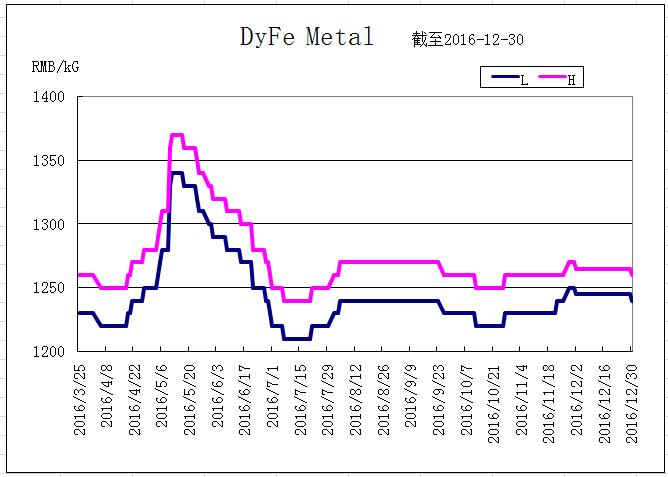

本周稀土市场金属镨钕和镝铁价格有小幅下调,铽价格相对稳定。亚洲金属网价格:镨钕金属334-337元/KG,镝铁合金价格1240-1260元/KG,铽金属价格3900-3950元/KG。

This week the price of PrNd and DyFe had a slight decrease but the Tb is relevantly stable. The price at weekend from Asia metal presented as: PrNd 334-337 RMB/KG, DyFe 1240-1260 RMB/KG and Tb metal 3900-3950 RMB/KG.

截至26日,新的稀土综合价格指数报1052.03点,较前一工作日上涨5.53点,涨幅为0.53%。相比2016年10月31日时1000点的基期上涨52.03点。自该指数投入运营以来,呈先抑后扬态势,整体在950点至1050点之间波动。

Till 26th, the latest rare earth aggregate price index is 1052.03 which increased 5.53 point compare to the last workday and increase rate is 0.53%. The index increased 52.03 point compare to the base value 1000 point on Oct.31st, 2016. Since the index was put into operation, it shows a status of rise before inhibition but basically fluctuate between 950 and 1050.

2.业内人士分析Analysis of Professional Insiders

在市场较为低迷的情况下,国家实施稀土储备,向市场发出积极信号,也给企业吃了一颗定心丸,对整个稀土价格推动是非常有好处的。就目前稀土行业面临的发展环境而言,采取国储的政策措施,既是保持稀土行业健康、稳定、可持续发展的要求,也是国家意志在稀土这一重要战略产业发挥作用的抓手,这一政策并不违反经济规律。此次国家层面展开的稀土储备,是一种具有吞吐作用的储备。政策逐步出台执行有望推动稀土市场行情持续深化,稀土供给侧改革有望由“量变"引起“质变"。如果通过稀土国储,促进稀土价格上涨,那么,企业将更多实惠。

Under the circumstance of the market is relatively weak, the state implement the rare earth reserves policy which gives a positive signal to the market and soothes company's nerves and it is very good to promote the rare earth price as well. According to the current rare earth industry situation, the national reserves policy will not only help to keep healthy, stable and sustainable development but also shows national will play an important role in strategic industry, which do not violate economic law. The national level to reserve rare earths has a stimulation effect. Step by step implementation of policy is expected to promote the rare earth market continues to deepen and rare earth supply side reform is expected to be changed from quantity to qualitative. If the rare earth price rises due to national reserves policy, many companies will get benefits.

今日稀土市场仍持稳运行,镨钕镝铽类产品弱势,市场“买涨不买跌"心态常见,节日效应下市场询盘皆清淡,各方仍观望为主。

Currently the rare earth market is running steady and PrNd, DyFe, Tb is in the weakness. With the psychology of buying after rising not falling, the inquiry is quite weak and all parties still wait and see.

今日SMM主流报价如下,氧化镨主流厂家含税价320,000-330,000元/吨,氧化钕258,000-260,000元/吨,金属钕33.5-34.0万元/吨,氧化镨钕主流厂家含税258,000-260,000元 /吨,镨钕金属主流厂家含税价336,000~339,000元/吨。金属铽主流厂家含税价3850-3950元/千克。氧化镝主流厂家含税119-121万元/吨,镝铁厂家含税价123-125万元/吨。

SMM mainstream today offer as follows, praseodymium oxide mainstream manufacturers tax-included price is 320,000-330,000 RMB/T, neodymium oxide is 258,000-260,000 RMB/T, neodymium metal is 335,000-340,000 RMB/T, neodymium praseodymium oxide mainstream manufacturers tax-included price is 258,000-260,000 RMB/T, praseodymium neodymium metal mainstream manufacturers tax-included price is 336,000 ~ 339,000 RMB/T. Terbium metal mainstream manufacturers tax-included price is 3850-3950 RMB/KG, dysprosium oxide mainstream manufacturers tax-included price is 1.19-1.21 million RMB/T, dysprosium tax-included price is 1.23-1.25 million RMB/T.

3.趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

2016年12月30日

Dec.30th, 2016

提示:以上信息仅供参考!

Notes: the information above is for reference only!

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :