JL MAG Rare-earth Industry Price Briefing 2416(Issue No.508)05-13~05-17

Week 20,2024

1. 重要新闻简报Briefing of Important News

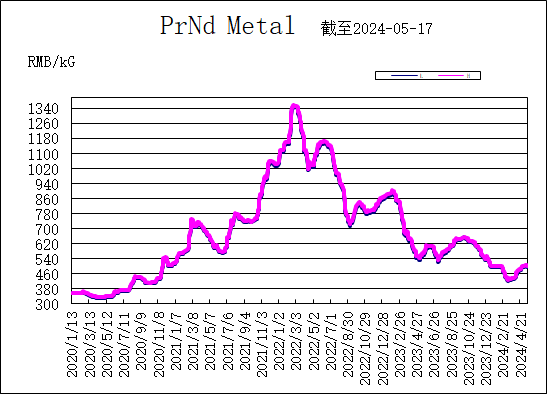

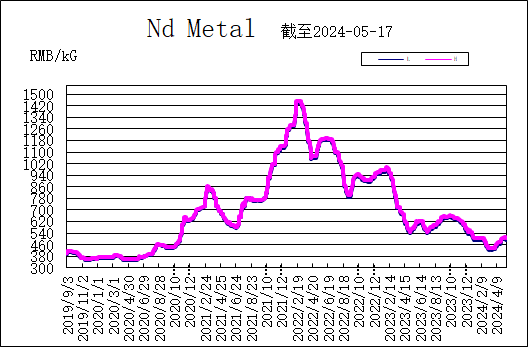

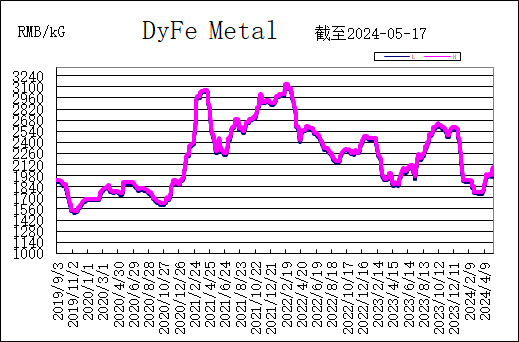

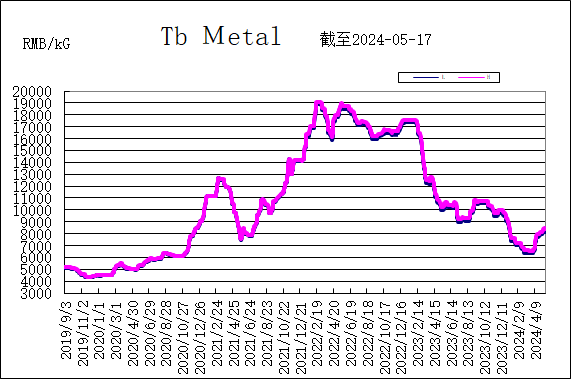

本周稀土市场行情,镨钕、金属钕、镝铁合金以及金属铽价格均出现小幅下跌。亚洲金属网周末价格: 镨钕金属价格495-500元/KG;金属钕价格495-505元/KG;镝铁合金价格1990-2010元/KG;金属铽价格8150-8350元/KG。

This week, the prices of PrNd, Nd metal, DyFe alloy and Tb metal have slightly decreased. Prices from Asian Metal at this weekend presented: PrNd metal 495-500 RMB/KG; Nd metal 495-505 RMB/KG; DyFe alloy 1990-2010 RMB/KG; Tb metal 8150-8350 RMB/KG.

2. 业内人士分析Analysis of Professional Insiders

稀土市场经历了近2个月的持涨,本周(5.13-17,下同)稀土市场一波三折,市价小V走势再次重现,极限演绎涨跌一瞬间。

After nearly two months of consistent growth, the rare earth market experienced twists and turns this week (May 13-17, the same below), with a small V-shaped price movement reappearing, demonstrating extreme fluctuations in a blink of an eye.

本周三个时间节点:①周前期,虽然镨钕已有回调趋势,部分贸易商小幅让价,但大厂保稳,整体市场挺价信心明显;②周中期,在询采偏淡,拉涨效果不佳,成交较难的表象下,持货商主动让价幅度增大;③周后期,大企业补采随之而进,市场信心得以修复,报价开始由低转高。

There were three key time nodes this week: ①In the early of the week, while PrNd showed signs of downward and some traders offered small discounts, major manufacturers remained stable, and overall market confidence in maintaining prices was evident. ②In the middle of the week, due to weak inquiry and procurement, poor performance in boosting prices, and difficulty in closing transactions, holders took the initiative to increase the price range. ③In the later stage of the week, as large enterprises stepped up their procurement, market confidence was restored, and prices began to rebound from lows.

后续稀土走势有望保持稳健的窄幅调整,若要再度实现高涨幅确需新的外力利好,包括出口单的提振。环保,集中采买,贸易操作都将影响已有的稀土价格,当前价位,已博弈良久,短期内镨钕有可能继续维稳窄荡,部分重稀土产品因市场份额及集中度或有继续看好的预期。对企业操作而言,原本的市场竞争有可能会加剧,企业既要下好先手棋,也要留有后手牌。(瑞道稀土资讯)

The trend of rare earth is expected to maintain a stable narrow range adjustment in the future. If we want to achieve a high rise again, we will need new external benefits, including a boost in export orders. Environmental protection, centralized procurement, and trade operations will all affect existing rare earth prices. The current price level has been subject to intense negotiations, and in the short term, PrNd is likely to continue to maintain stability with narrow fluctuations. Some heavy rare earth products may be expected to continue to perform well due to market share and concentration. For enterprises, the original market competition may intensify, requiring them to play their cards strategically while also leaving room for maneuver. (Ruidow Rare Earth Information)

3. 趋势图(参考亚洲金属网)Tendency Chart (refer to Asian Metal)

![]()

![]()

2024年05月17日

May 17th, 2024

Follow Us

Follow Us

Stock Code

Stock Code  Language

Language

Location :

Location :